How I Help You Buy Your Home

Helping you find and purchase a home is only one facet of my job.

In addition, I will:

■ Explain real estate principles, contracts and documents

■ Refer you to a reputable lender that can help you assess your financial situation and pre-approve you for a loan

■ Help you determine the types of homes and neighborhoods that most fit your needs

■ Arrange tours of homes that meet your criteria

■ Provide you with detailed information about homes you’re interested in

■ Determine the market value of homes you’re interested in

■ Assist you in writing and negotiating a mutually-accepted purchase and sale agreement

■ Accompany you to the inspection

■ Coordinate necessary steps after inspection

■ Work with the escrow company to ensure all needed documents are in order and completed in a timely manner

So by working with me, you will:

■ Be more likely to find the home that meets all your criteria

■ Decrease the amount of time it takes to find your home

■ Understand all the terms, processes and documents involved

■ Have current market information to make informed decisions

■ Have a skilled negotiator on your side

■ Have peace of mind that all the details are being handled

How I Help You Buy Your Home

Helping you find and purchase a home is only one facet of my job.

In addition, I will:

■ Explain real estate principles, contracts and documents

■ Refer you to a reputable lender that can help you assess your financial situation and pre-approve you for a loan

■ Help you determine the types of homes and neighborhoods that most fit your needs

■ Arrange tours of homes that meet your criteria

■ Provide you with detailed information about homes you’re interested in

■ Determine the market value of homes you’re interested in

■ Assist you in writing and negotiating a mutually-accepted purchase and sale agreement

■ Accompany you to the inspection

■ Coordinate necessary steps after inspection

■ Work with the escrow company to ensure all needed documents are in order and completed in a timely manner

So by working with me, you will:

■ Be more likely to find the home that meets all your criteria

■ Decrease the amount of time it takes to find your home

■ Understand all the terms, processes and documents involved

■ Have current market information to make informed decisions

■ Have a skilled negotiator on your side

■ Have peace of mind that all the details are being handled

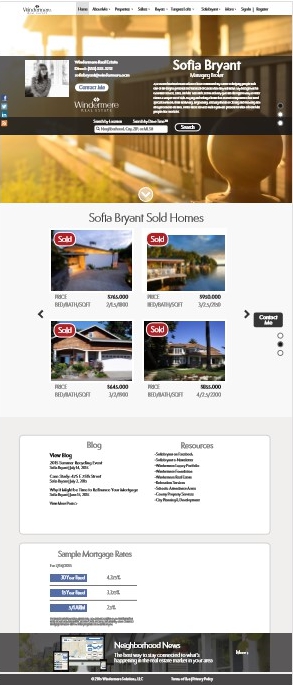

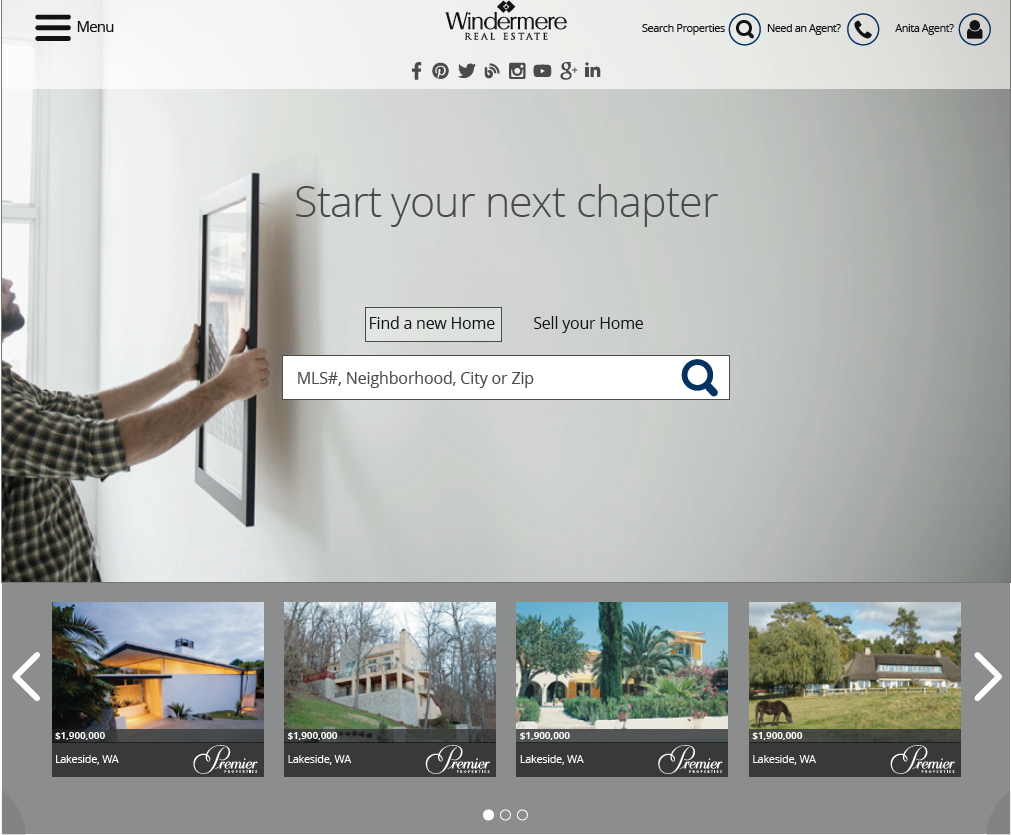

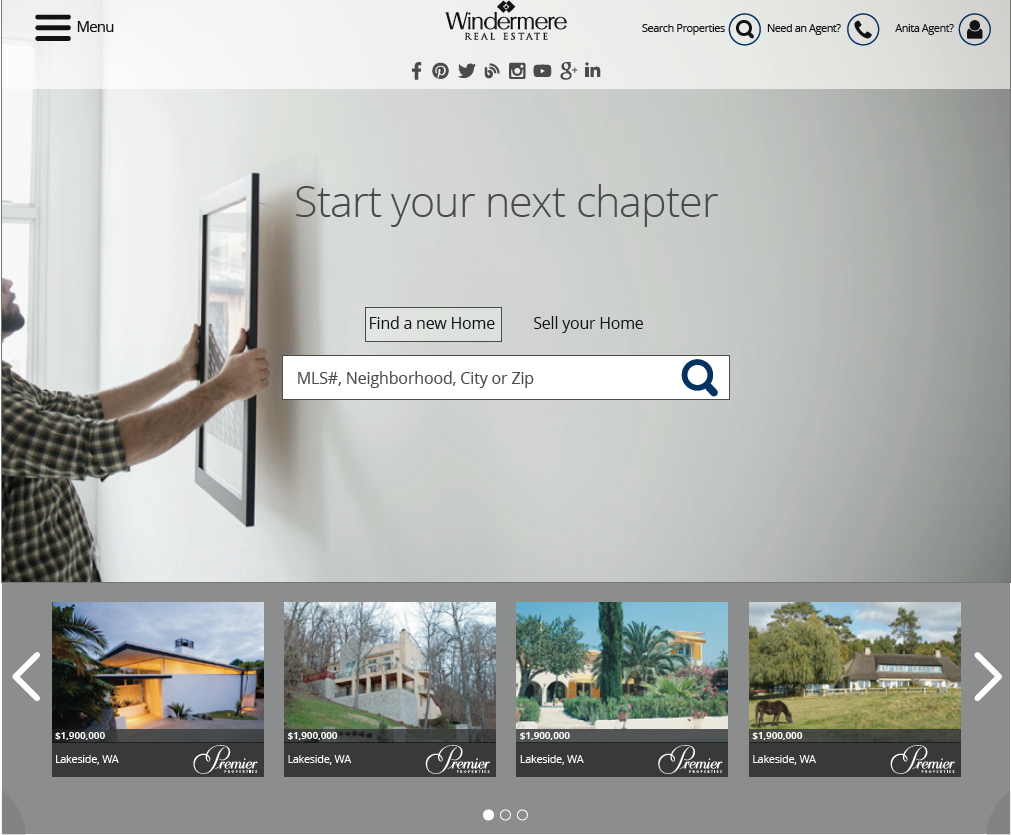

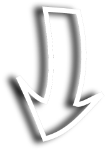

My Agent Website

When you visit my website, the most current real estate listing information available is within your reach. Once on my site, sign up for your own myWindermere account to create multiple saved searches and favorite listings, receive automatic emails, and even collaborate with me directly on the site to find the home that's right for you.

My website also offers:

■ Information about every MLS listing available in your area

■ Easy around-the-clock access to my featured listings

■ Buying and selling tips

■ Financial calculators

■ My contact information and professional profile

■ The Windermere blog

My Agent Website

When you visit my website, the most current real estate listing information available is within your reach. Once on my site, sign up for your own myWindermere account to create multiple saved searches and favorite listings, receive automatic emails, and even collaborate with me directly on the site to find the home that's right for you.

My website also offers:

■ Information about every MLS listing available in your area

■ Easy around-the-clock access to my featured listings

■ Buying and selling tips

■ Financial calculators

■ My contact information and professional profile

■ The Windermere blog

How much house can you afford?

FINANCING

Determining how much you can afford before you begin your home search will save you valuable time.

I can help you locate a lender who will assist you in finding a financing package that will best meet your needs. But there are a few steps you should consider beforehand to make the process as smooth as possible:

CREDIT REPORT

It’s important to check your credit report before you see your lender because:

■ Lenders check this to determine the amount of loan you qualify for

■ It allows you to correct any mistakes in the report before lenders see it

■ If there are any blemishes in your report that are not errors, you should be prepared to explain them to your lender

You are entitled to one free request each year from each of the three credit bureaus. The best way to do this is to go online to AnnualCreditReport.com.

CREDIT SCORE

You may want to check your credit score at the same time you check your credit report (usually for a fee). This score influences how much lenders are willing to loan to you and at what interest rate.

DOWN PAYMENT

Most lenders will give better financing terms to borrowers that can put a 20 percent down payment on the purchase. If you are unable to do so, you will likely be required to purchase Private Mortgage Insurance (PMI) and perhaps pay a higher interest rate.

PREAPPROVAL

A letter of preapproval from a lender shows that they have checked all your documentation and are prepared to make you a loan. Getting preapproved prior to starting your home search saves you time by:

■ Keeping you focused on viewing only the homes that are within your budget

■ Helping you obtain your financing more quickly once you find a house you want to buy

FINANCING

How much house can you afford?

Determining how much you can afford before you begin your home search will save you valuable time.

I can help you locate a lender who will assist you in finding a financing package that will best meet your needs. But there are a few steps you should consider beforehand to make the process as smooth as possible:

CREDIT REPORT

It’s important to check your credit report before you see your lender because:

■ Lenders check this to determine the amount of loan you qualify for

■ It allows you to correct any mistakes in the report before lenders see it

■ If there are any blemishes in your report that are not errors, you should be prepared to explain them to your lender

You are entitled to one free request each year from each of the three credit bureaus. The best way to do this is to go online to AnnualCreditReport.com.

CREDIT SCORE

You may want to check your credit score at the same time you check your credit report (usually for a fee). This score influences how much lenders are willing to loan to you and at what interest rate.

DOWN PAYMENT

Most lenders will give better financing terms to borrowers that can put a 20 percent down payment on the purchase. If you are unable to do so, you will likely be required to purchase Private Mortgage Insurance (PMI) and perhaps pay a higher interest rate.

PREAPPROVAL

A letter of preapproval from a lender shows that they have checked all your documentation and are prepared to make you a loan. Getting preapproved prior to starting your home search saves you time by:

■ Keeping you focused on viewing only the homes that are within your budget

■ Helping you obtain your financing more quickly once you find a house you want to buy

Identifying Your Priorities

Identifying Your Priorities

Answers to Frequently Asked

QUESTIONS

WHAT IF I NEED TO SELL MY HOME BEFORE I BUY A NEW ONE?

To put yourself in the best negotiating position before you find the new home you want, hire a qualified real estate agent to help you put your home on the market. Once you write an offer on a new home, your offer will be “contingent” upon the sale of your home. A buyer in this position may not have the same negotiating power as one whose home has already sold (or at least has an accepted offer). The seller may be hesitant to accept your offer because there are too many things that must happen before the sale can close.

HOW DOES MY OFFER GET PRESENTED TO THE SELLER?

I will call the agent who is the listing agent for the home you have chosen. We will make arrangements with the seller to present your offer. I will be there to explain the details of your offer and negotiate on your behalf.

WHAT HAPPENS IF I OFFER LESS THAN THE ASKING PRICE?

If you offer less money, the seller has three options. They can accept the lower offer, counter your offer or reject it completely. Remember that there could be another buyer who is also interested in the home you’ve chosen. If they happen to write an offer at the same time you do, the seller will have two offers to compare. There are usually many aspects of each offer to consider, but ultimately the seller will want to accept the best and most complete offer. In active real estate markets, homes often sell for their listed price. In hot markets, there may be many buyers vying for the same house, which sometimes drives the final sale price above the original listing price.

As a real estate professional, I can help you plan your strategy, based on the current real estate market in our area.

DOES IT COST ME MONEY TO MAKE AN OFFER?

When you write the offer on the home you’ve chosen, you will be expected to include an earnest money deposit. The deposit is a sign of your good faith that you are seriously interested in buying the home.

WHERE DOES MY EARNEST MONEY GO?

Once the buyer and seller have a mutually accepted offer, the earnest money is deposited into a trust account. That deposit becomes a credit to the buyer and becomes part of the purchase expense.

CAN I LOSE MY EARNEST MONEY?

Real estate contracts are complicated legal transactions. This is another area where having a knowledgeable and professional agent is a necessity. Rarely does the buyer lose the earnest money. Most often, if the transaction falls apart, there are circumstances beyond the buyer’s control that cause it to happen. If the buyer willfully decides, however, that they no longer want to buy the house and has no legal reason for rescinding their offer, then the seller has the right to retain the earnest money.

IS THAT ALL THE MONEY THAT’S INVOLVED?

Some lenders require the cost of the appraisal and credit report at the time of the loan application.

Answers to Frequently Asked

QUESTIONS

Q: WHAT IF I NEED TO SELL MY HOME BEFORE I BUY A NEW ONE?

A: To put yourself in the best negotiating position before you find the new home you want, hire a qualified real estate agent to help you put your home on the market. Once you write an offer on a new home, your offer will be “contingent” upon the sale of your home. A buyer in this position may not have the same negotiating power as one whose home has already sold (or at least has an accepted offer). The seller may be hesitant to accept your offer because there are too many things that must happen before the sale can close.

Q: HOW DOES MY OFFER GET PRESENTED TO THE SELLER?

A: I will call the agent who is the listing agent for the home you have chosen. We will make arrangements with the seller to present your offer. I will be there to explain the details of your offer and negotiate on your behalf.

Q: WHAT HAPPENS IF I OFFER LESS THAN THE ASKING PRICE?

A: If you offer less money, the seller has three options. They can accept the lower offer, counter your offer or reject it completely. Remember that there could be another buyer who is also interested in the home you’ve chosen. If they happen to write an offer at the same time you do, the seller will have two offers to compare. There are usually many aspects of each offer to consider, but ultimately the seller will want to accept the best and most complete offer. In active real estate markets, homes often sell for their listed price. In hot markets, there may be many buyers vying for the same house, which sometimes drives the final sale price above the original listing price.

As a real estate professional, I can help you plan your strategy, based on the current real estate market in our area.

Q: DOES IT COST ME MONEY TO MAKE AN OFFER?

A: When you write the offer on the home you’ve chosen, you will be expected to include an earnest money deposit. The deposit is a sign of your good faith that you are seriously interested in buying the home.

Q: WHERE DOES MY EARNEST MONEY GO?

A: Once the buyer and seller have a mutually accepted offer, the earnest money is deposited into a trust account. That deposit becomes a credit to the buyer and becomes part of the purchase expense.

Q: CAN I LOSE MY EARNEST MONEY?

A: Real estate contracts are complicated legal transactions. This is another area where having a knowledgeable and professional agent is a necessity. Rarely does the buyer lose the earnest money. Most often, if the transaction falls apart, there are circumstances beyond the buyer’s control that cause it to happen. If the buyer willfully decides, however, that they no longer want to buy the house and has no legal reason for rescinding their offer, then the seller has the right to retain the earnest money.

Q: IS THAT ALL THE MONEY THAT’S INVOLVED?

A: Some lenders require the cost of the appraisal and credit report at the time of the loan application.

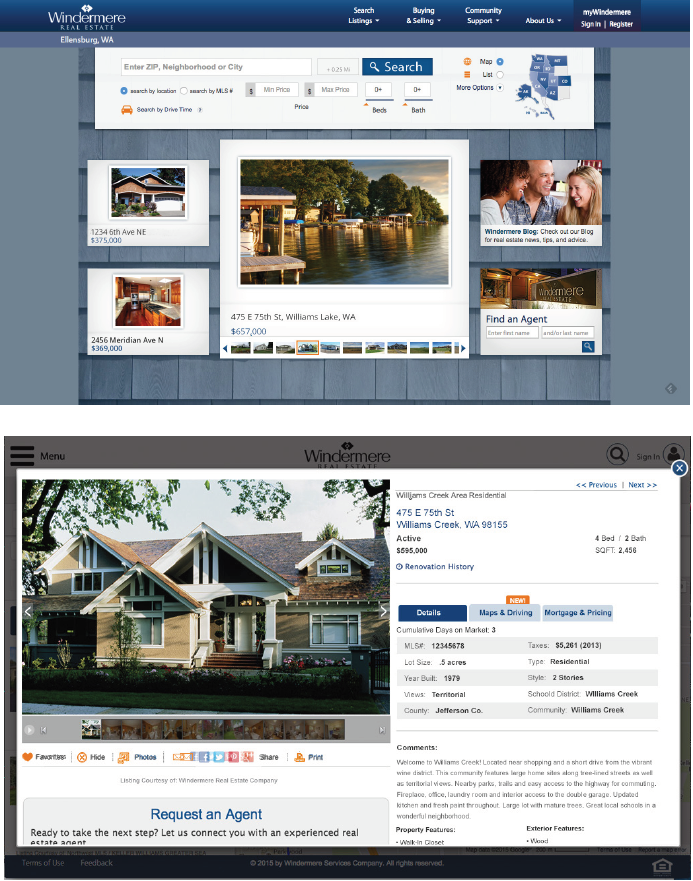

Find your home on

WINDERMERE.COM

Whether you’re just dreaming or ready to make a move, start your search on Windermere.com.

Windermere.com has:

■ Online collaboration with your Windermere agent

■ On average 1 million monthly visits

■ On average 500,000 property listings

■ Information about every MLS listing available in your area

■ Enhanced search capabilities and image viewer

■ A “save your favorites” feature

■ RSS feeds of new listings that match your search criteria

■ Open House search

■ Featured “Showcase” and “Premier” homes on the home page

■ Share tools for email and social media

In addition to searching for homes, buyers and sellers use Windermere.com to:

■ Better understand the buying or selling process

■ Read the Windermere blog

■ Use the mortgage calculator

■ Brush up on real estate terms

■ Find a Windermere office or agent to work with

Let the power of technology and Windermere.com work for you.

Find your home on

WINDERMERE.COM

Whether you’re just dreaming or ready to make a move, start your search on Windermere.com.

Windermere.com has:

■ Online collaboration with your Windermere agent

■ On average 1 million monthly visits

■ On average 500,000 property listings

■ Information about every MLS listing available in your area

■ Enhanced search capabilities and image viewer

■ A “save your favorites” feature

■ RSS feeds of new listings that match your search criteria

■ Open House search

■ Featured “Showcase” and “Premier” homes on the home page

■ Share tools for email and social media

In addition to searching for homes, buyers and sellers use Windermere.com to:

■ Better understand the buying or selling process

■ Read the Windermere blog

■ Use the mortgage calculator

■ Brush up on real estate terms

■ Find a Windermere office or agent to work with

Let the power of technology and Windermere.com work for you.

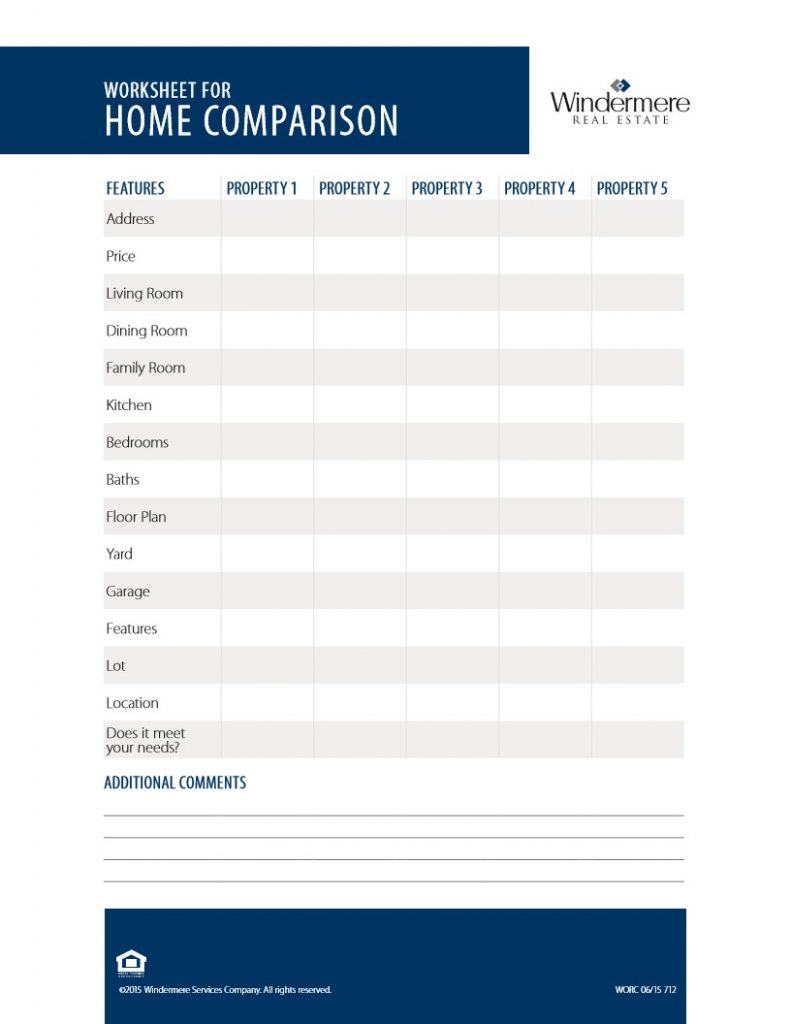

BUYER'S TERMS

LOAN AMOUNT

The amount of the mortgage based on the purchase price, minus the down payment.

DOWN PAYMENT

Cash that the buyer provides the lender as their portion of the purchase price. The down payment is considered the buyer’s equity (or cash investment) in their home.

POINTS

Fees charged by the lender to offset their interest rate, if it’s below the prevailing market rate. One point equals one percentage point—so one point on a $100,000 loan would be $1,000.

APPRAISAL FEE

The amount paid for the lender’s appraisal of the property.

CREDIT REPORT FEE

The fee charged by the lender to obtain a credit report on the buyer.

TITLE INSURANCE FEE

A one-time premium that a buyer pays for protection against loss or damage in the event of an incorrect search of public records or misinterpretation of title. The title insurance policy also shows what the property is subject to in terms of liens, taxes, encumbrances, deed restrictions and easements.

ESCROW FEE

The amount a buyer pays the escrow company or closing agent for preparing papers, accounting for all funds and coordinating the information between all parties involved in the transaction.

CLOSING COSTS

A general term for all the estimated charges associated with the transfer of ownership of the property.

PREPAID INTEREST

The amount of interest due on the loan during the time period between the closing of escrow and the first mortgage payment, due at the time of closing.

PITI

The estimated house payment, including principal, interest, taxes and insurance.

PRINCIPAL AND INTEREST

The loan payment, consisting of the amount to be applied against the balance of the loan, and the interest payment, which is charged for interest on the loan.

TOTAL CASH REQUIRED

The total amount of cash the buyer will need, including down payment and closing costs.

PREMIUM MORTGAGE INSURANCE (PMI)

Insurance for the lender, to cover potential losses if the borrower defaults on the loan.

BUYER'S TERMS

LOAN AMOUNT

The amount of the mortgage based on the purchase price, minus the down payment.

DOWN PAYMENT

Cash that the buyer provides the lender as their portion of the purchase price. The down payment is considered the buyer’s equity (or cash investment) in their home.

POINTS

Fees charged by the lender to offset their interest rate, if it’s below the prevailing market rate. One point equals one percentage point—so one point on a $100,000 loan would be $1,000.

APPRAISAL FEE

The amount paid for the lender’s appraisal of the property.

CREDIT REPORT FEE

The fee charged by the lender to obtain a credit report on the buyer.

TITLE INSURANCE FEE

A one-time premium that a buyer pays for protection against loss or damage in the event of an incorrect search of public records or misinterpretation of title. The title insurance policy also shows what the property is subject to in terms of liens, taxes, encumbrances, deed restrictions and easements.

ESCROW FEE

The amount a buyer pays the escrow company or closing agent for preparing papers, accounting for all funds and coordinating the information between all parties involved in the transaction.

CLOSING COSTS

A general term for all the estimated charges associated with the transfer of ownership of the property.

PREPAID INTEREST

The amount of interest due on the loan during the time period between the closing of escrow and the first mortgage payment, due at the time of closing.

PITI

The estimated house payment, including principal, interest, taxes and insurance.

PRINCIPAL AND INTEREST

The loan payment, consisting of the amount to be applied against the balance of the loan, and the interest payment, which is charged for interest on the loan.

TOTAL CASH REQUIRED

The total amount of cash the buyer will need, including down payment and closing costs.

PREMIUM MORTGAGE INSURANCE (PMI)

Insurance for the lender, to cover potential losses if the borrower defaults on the loan.

OFFICE WEBSITES

Another way to search for homes is to browse through the featured “Showcase” homes on our office website.

Our office website has:

■ Online collaboration with your Windermere agent

■ On average 475,000 property listings

■ Information about every MLS listing available in your area

■ Enhanced search capabilities and image viewer

■ A “save your favorite” feature

■ RSS feeds of new listings that match your search criteria

■ Open House search

■ Our office’s featured “Showcase” homes on home page

■ Share tools for email and social media

■ Discover Your Neighborhood page, for users to search local information

In addition to searching for homes, Buyers and Sellers use our office website to:

■ Better understand the buying or selling process

■ Read the Windermere blog

■ Use the mortgage calculator

■ Brush up on real estate terms

■ Find a list of the agents in our office

Let the power of technology and Windermere.com work for you.

OFFICE WEBSITES

Another way to search for homes is to browse through the featured “Showcase” homes on our office website.

Our office website has:

■ Online collaboration with your Windermere agent

■ On average 475,000 property listings

■ Information about every MLS listing available in your area

■ Enhanced search capabilities and image viewer

■ A “save your favorite” feature

■ RSS feeds of new listings that match your search criteria

■ Open House search

■ Our office’s featured “Showcase” homes on home page

■ Share tools for email and social media

■ Discover Your Neighborhood page, for users to search local information

In addition to searching for homes, Buyers and Sellers use our office website to:

■ Better understand the buying or selling process

■ Read the Windermere blog

■ Use the mortgage calculator

■ Brush up on real estate terms

■ Find a list of the agents in our office

Let the power of technology and Windermere.com work for you.

Considering a short sale?

WINDERMERE CAN HELP

If you are considering buying a short sale property, we can help you understand your options and guide you through what may be unfamiliar territory so that you can make the decision that is best for you.

WHAT IS A SHORT SALE?

A short sale occurs when a homeowner and the bank agree to sell a home for less than is actually owed on the property. The bank makes more than it might through foreclosure, and the homeowner is able to settle their debt and avoid the negative effects that can result from the foreclosure process.

BUYING A SHORT SALE

Short sales can offer significant savings since they usually sell for well under the median home price. In 2014, the typical short sale home sold for about 37 percent less than a non-distressed, median-priced home. Before making any offers on a short sale property, you’ll need to make sure you’re pre-approved and contingency-free. Sellers in these situations are usually only willing to consider offers from well-qualified buyers. One advantage of buying short sales over foreclosure properties is that the condition of short sale homes is usually much better because the owner has a vested interest in the sale.

BE AWARE

The name "short sale" is deceiving, as it can take several months to process the paperwork and get all parties to agree to the terms (longer even than a bank-owned transaction). One way to speed up a short sale is if the seller works through the Federal Home Affordable Foreclosure Alternatives program, which can be effective at holding everyone (including lenders) accountable to a pre-established timeline.

GETTING PROFESSIONAL HELP

If you are considering purchasing a short sale, being well informed is key since these are complex transactions. You’ll want an experienced real estate agent to help you assess any properties and determine a fair offer price. Whatever your situation and goals, the vast resources of the Windermere network allow us to provide the appropriate expertise to achieve the best outcome for you.

Considering a short sale?

WINDERMERE CAN HELP

If you are considering buying a short sale property, we can help you understand your options and guide you through what may be unfamiliar territory so that you can make the decision that is best for you.

WHAT IS A SHORT SALE?

A short sale occurs when a homeowner and the bank agree to sell a home for less than is actually owed on the property. The bank makes more than it might through foreclosure, and the homeowner is able to settle their debt and avoid the negative effects that can result from the foreclosure process.

BUYING A SHORT SALE

Short sales can offer significant savings since they usually sell for well under the median home price. In 2014, the typical short sale home sold for about 37 percent less than a non-distressed, median-priced home. Before making any offers on a short sale property, you’ll need to make sure you’re pre-approved and contingency-free. Sellers in these situations are usually only willing to consider offers from well-qualified buyers. One advantage of buying short sales over foreclosure properties is that the condition of short sale homes is usually much better because the owner has a vested interest in the sale.

BE AWARE

The name "short sale" is deceiving, as it can take several months to process the paperwork and get all parties to agree to the terms (longer even than a bank-owned transaction). One way to speed up a short sale is if the seller works through the Federal Home Affordable Foreclosure Alternatives program, which can be effective at holding everyone (including lenders) accountable to a pre-established timeline.

GETTING PROFESSIONAL HELP

If you are considering purchasing a short sale, being well informed is key since these are complex transactions. You’ll want an experienced real estate agent to help you assess any properties and determine a fair offer price. Whatever your situation and goals, the vast resources of the Windermere network allow us to provide the appropriate expertise to achieve the best outcome for you.

Buying your FIRST HOME

Buying your FIRST HOME

The prospect of buying your first home can be both exhilarating and scary at the same time. It’s likely the largest purchase you’ll make in your lifetime—and also one of the best long-term investments. But buying a home is not a one-size-fits-all proposition. Finding the right place in the perfect neighborhood, and at a cost that’s within your budget, is no small task. That’s where I come in. My job is to help you navigate the twists and turns of the buying process, so that you end up with a house you’re proud to call home.

HERE IS HOW I WILL HELP YOU:

■ Explain the entire real estate process from start to finish so there are no surprises

■ Recommend a lender that can help you determine how much you can afford and pre-approve you for a home loan

■ Help you determine the types of homes and neighborhoods that best fit your needs

■ Arrange tours of homes that meet your search criteria

■ Provide you with detailed information about homes you’re interested in

■ Determine the market value of homes you’re interested in

■ Assist you in writing and negotiating a mutually-accepted purchase and sale agreement

■ Accompany you to the inspection

■ Coordinate necessary steps after inspection

■ Work with the escrow company to ensure all needed documents are in order and completed in a timely manner

■ Provide ongoing support and services even after you’ve moved into your new home

Buying your FIRST HOME

Buying your FIRST HOME

The prospect of buying your first home can be both exhilarating and scary at the same time. It’s likely the largest purchase you’ll make in your lifetime—and also one of the best long-term investments. But buying a home is not a one-size-fits-all proposition. Finding the right place in the perfect neighborhood, and at a cost that’s within your budget, is no small task. That’s where I come in. My job is to help you navigate the twists and turns of the buying process, so that you end up with a house you’re proud to call home.

HERE IS HOW I WILL HELP YOU:

■ Explain the entire real estate process from start to finish so there are no surprises

■ Recommend a lender that can help you determine how much you can afford and pre-approve you for a home loan

■ Help you determine the types of homes and neighborhoods that best fit your needs

■ Arrange tours of homes that meet your search criteria

■ Provide you with detailed information about homes you’re interested in

■ Determine the market value of homes you’re interested in

■ Assist you in writing and negotiating a mutually-accepted purchase and sale agreement

■ Accompany you to the inspection

■ Coordinate necessary steps after inspection

■ Work with the escrow company to ensure all needed documents are in order and completed in a timely manner

■ Provide ongoing support and services even after you’ve moved into your new home

Wayne Martin

Broker / Owner of Windermere NorCal Properties

Wayne started his Real Estate Career at a young age working with his father and uncle in their construction companies. He got his real estate license at 22 working for a local Shasta County Real Estate Office. At the same time, he was building spec homes and continuing to work as a general contractor.

In 1981, Wayne moved to the Monterey Peninsula. Over the years, he became a builder-developer. He built single family custom homes, sub-divisions, medical and commercial buildings. He owned and operated hotels and apartment buildings.

In 1996 he and his wife, Freddie, moved to the Sacramento area where Wayne got his real estate broker’s license. Freddie joined him in the business in 1998 and they started Real Estate 1. They opened a mortgage company in conjunction with their real estate brokerage. Within a few years, they were selling 100+ homes per year.

In 2003, they tired of the congestion in the Sacramento area and moved to Shasta County to work in the Real Estate 1 office in Redding with their daughter, Denise.

In 2011, they decided to become a Windermere franchise because of the many marketing benefits for their clients.

Because of his in-depth knowledge of real estate, construction, finance and negotiation, along with his friendly and focused attention to his client’s needs and goals, Wayne’s clients have a “leg up” over the competition when either selling or purchasing real estate.

Wayne’s dedication to serving through teaching and educating numerous professional peers, along with his outstanding sales achievements, earned him the prestigious Shasta Association of Realtors-Realtor of the Year Award in 2007.

For fun, Wayne leads Porsche driving tours throughout Northern California in his spare time. Wayne is the elected President of the Porsche Club of America, Shasta Region.

Wayne Martin

Broker / Owner of Windermere NorCal Properties

Wayne started his Real Estate Career at a young age working with his father and uncle in their construction companies. He got his real estate license at 22 working for a local Shasta County Real Estate Office. At the same time, he was building spec homes and continuing to work as a general contractor.

In 1981, Wayne moved to the Monterey Peninsula. Over the years, he became a builder-developer. He built single family custom homes, sub-divisions, medical and commercial buildings. He owned and operated hotels and apartment buildings.

In 1996 he and his wife, Freddie, moved to the Sacramento area where Wayne got his real estate broker’s license. Freddie joined him in the business in 1998 and they started Real Estate 1. They opened a mortgage company in conjunction with their real estate brokerage. Within a few years, they were selling 100+ homes per year.

In 2003, they tired of the congestion in the Sacramento area and moved to Shasta County to work in the Real Estate 1 office in Redding with their daughter, Denise.

In 2011, they decided to become a Windermere franchise because of the many marketing benefits for their clients.

Because of his in-depth knowledge of real estate, construction, finance and negotiation, along with his friendly and focused attention to his client’s needs and goals, Wayne’s clients have a “leg up” over the competition when either selling or purchasing real estate.

Wayne’s dedication to serving through teaching and educating numerous professional peers, along with his outstanding sales achievements, earned him the prestigious Shasta Association of Realtors-Realtor of the Year Award in 2007.

For fun, Wayne leads Porsche driving tours throughout Northern California in his spare time. Wayne is the elected President of the Porsche Club of America, Shasta Region.

530.355.5805 waynemartin@windermere.com BRE#01221154

Fredericka (Freddie) Martin

President of Windermere NorCal Properties

Freddie started her Real Estate Career at a young age when she was hired as a “plant poster” at a title insurance company right out of high school. With hard work, focus and perseverance she eventually became a county manager in Monterey County for one of the largest title and escrow insurance companies in the world.

She and her husband, Wayne Martin, decided to open Real Estate 1, a real estate brokerage in 1998. They also opened RE1 Financial Inc., a mortgage company around the same period. After a few years in business, they were helping their clients close over 100 real estate properties per year in the Greater Sacramento area.

They decided to move to Shasta County in 2003 to join their daughter in a real estate brokerage. Over the years they have helped thousands of people realize their dreams of homeownership. They worked with their clients to sell their homes for the highest price in the least amount of time and with the least amount of challenges. They also have experience selling land, investment and commercial properties. In 2011 the Martins decided to become a Windermere Franchise office because of the many marketing and servicing benefits the company brought to their clients.

The Martins are involved in community projects and give generously to various non-profit organizations. A portion of every commission goes to the Windermere Foundation that has contributed over $33 million since 1989 to organizations benefiting women and children.

In 2009 Freddie was honored to receive the prestigious Shasta County Realtor of the Year award.

Wayne and Freddie have five children and seven grandchildren.

Freddie’s hobbies include creating mosaics and painting pictures of friend’s pets. She also loves to dance, workout, garden, hike and spend quality time with her many friends.

Fredericka (Freddie) Martin

President of Windermere NorCal Properties

Freddie started her Real Estate Career at a young age when she was hired as a “plant poster” at a title insurance company right out of high school. With hard work, focus and perseverance she eventually became a county manager in Monterey County for one of the largest title and escrow insurance companies in the world.

She and her husband, Wayne Martin, decided to open Real Estate 1, a real estate brokerage in 1998. They also opened RE1 Financial Inc., a mortgage company around the same period. After a few years in business, they were helping their clients close over 100 real estate properties per year in the Greater Sacramento area.

They decided to move to Shasta County in 2003 to join their daughter in a real estate brokerage. Over the years they have helped thousands of people realize their dreams of homeownership. They worked with their clients to sell their homes for the highest price in the least amount of time and with the least amount of challenges. They also have experience selling land, investment and commercial properties. In 2011 the Martins decided to become a Windermere Franchise office because of the many marketing and servicing benefits the company brought to their clients.

The Martins are involved in community projects and give generously to various non-profit organizations. A portion of every commission goes to the Windermere Foundation that has contributed over $33 million since 1989 to organizations benefiting women and children.

In 2009 Freddie was honored to receive the prestigious Shasta County Realtor of the Year award.

Wayne and Freddie have five children and seven grandchildren.

Freddie’s hobbies include creating mosaics and painting pictures of friend’s pets. She also loves to dance, workout, garden, hike and spend quality time with her many friends.

530.355.5806

freddiemartin@windermere. com

BRE#01229652

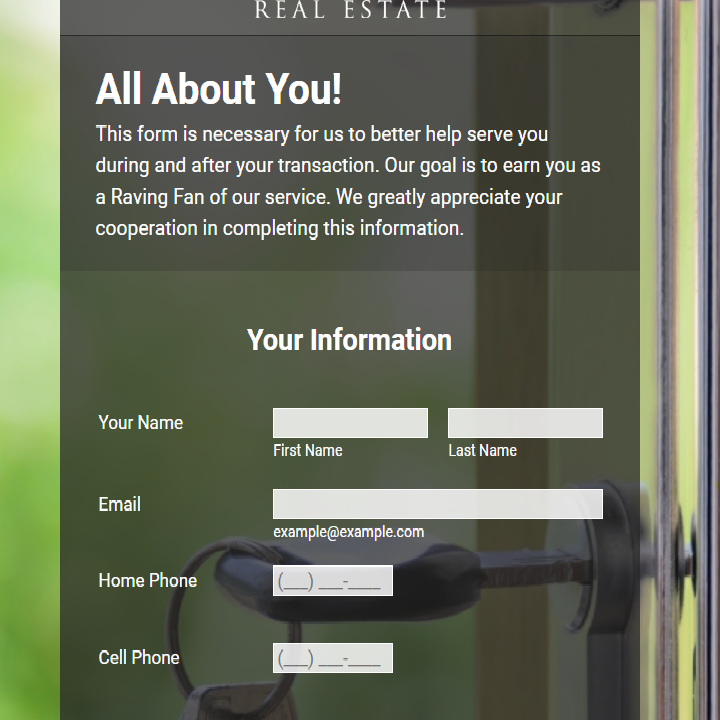

All About You!

This form is necessary for us to better help serve you during and after your transaction. Our goal is to earn you as a Raving Fan of our service. We greatly appreciate your cooperation in completing this information.

All About You!

This form is necessary for us to better help serve you during and after your transaction. Our goal is to earn you as a Raving Fan of our service. We greatly appreciate your cooperation in completing this information.

Buying your FIRST HOME

Buying your FIRST HOME